Frequently Asked Questions

What are FICO® Scores?

FICOQ9 Scmes are the most widely used credit scores. Each FICO@ Score is a three-digit number calculated from the data on your credit reports at the three major consumer reporting agencies-Experian, TransUnion and Equifax. Your FICO® Scores predict how likely you are to pay back a credit obligation as agreed Lenders use FICO® Scores to help them quickly, consistently and objectively evaluate potential borrowers’ credit risk.

What goes into FICO® Scores?

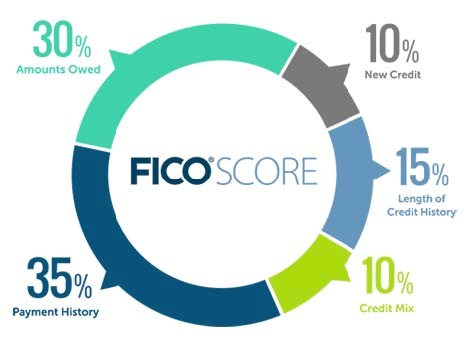

FICO® Scores are calculated from the credit data in your credit report. This data is grouped into five categories; the chart below shows the relative importance of each category.

- 35% – Payment History: Whether you’ve paid past credit accounts on time

- 30% – Amounts Owed: The amount of credit and loans you are using

- 15% – Length of credit history: How long you’ve had credit

- 10% – New Credit: Frequency of credit inquires and new account openings

- 10% – Credit Mix: The mix of your credit. retail accounts, installment loans, finance company accounts and mortgage loans

What are score factors?

Score factors are delivered with a consumer’s FICO® Score, these are the top areas that affected that consumer’s FICO® Scores. The order in which the score factors are listed is important. The first factor indicates the area that most affected the score and the second factor is the next most significant influence. Addressing these factors can benefit the score.

Why is my FICO® Score different than other scores I’ve seen?

There are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, and different lenders may use different versions of FICO® Scores. In addition, FICO@ Scores are based on credit file data from a consumer reporting agency, so differences in your credit files may create differences in your FICO® Scores.

Why do FICO® Scores fluctuate/change?

There are many reasons why a score may change. FICO@ Scores are calculated each time they are requested, taking into consideration the information that is in your credit file from a consumer reporting agency at that time. So, as the information in your credit file at that CRA changes, FICO@ Scores can also change. Review your key score factors, which explain what factors from your credit report most affected a score. Comparing key score factors from the two different time periods can help identify causes for a change in a FICO® Score. Keep in mind that certain events such as late payments or bankruptcy can lower FICO® Scores quickly.

How do I check my credit report for free?

You may get a free copy of your credit report from each of the three major consumer reporting agencies annually. To request a copy of your credit report, please visit www.annualcreditreport.com. Please note that your free credit report will not include your FICO® Score. Because your FICO® Score is based on the information in your credit report. it is important to make sure that the credit report information is accurate.

Will receiving my FICO® Score impact my credit?

No. The FICO@ Score we provide to you will not impact your credit.